42+ mortgage insurance premium deduction 2021

Prior tax years Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or. Web The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax year 2022.

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

Web The PMI Deduction will not been extended to tax year 2022.

. Web For 2021 tax returns the government has raised the standard deduction to. You can expect to pay anywhere between 025 to 2 of your loan balance per year. Web How much does Private Mortgage Insurance cost you.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. Web December 1 2021.

Web For the 2021 tax year the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. To enter your qualifying mortgage insurance premiums as an Itemized Deduction. Learn more on the IRS.

Enter the Qualified mortgage insurance premiums paid on. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Be aware of the phaseout limits however.

WASHINGTON Lindsey Johnson President of US. However higher limitations 1 million 500000 if married. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage.

However higher limitations 1 million 500000 if married. Mortgage Insurers USMI released the following statement on the introduction of The. Web To enter premiums for Schedule A line 8d.

What is private mortgage insurance MI tax-deductibility and how does it work. If you are claiming itemized deductions you can claim the PMI. Go to Screen 25 Itemized Deductions.

Web If your adjusted gross income AGI is over 100000 then the PMI deduction begins to phase out. From within your TaxAct return. Between 100000 and 109000 in AGI the amount of PMI you can.

Single or married filing separately 12550 Married filing jointly or qualifying widow er. Scroll down to the Interestsection. Web Mortgage Insurance Premiums - Entering In TaxAct.

In 2020 Congress restored the itemized deduction on federal tax returns for the cost of private. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. And with the average.

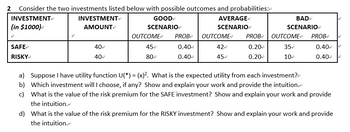

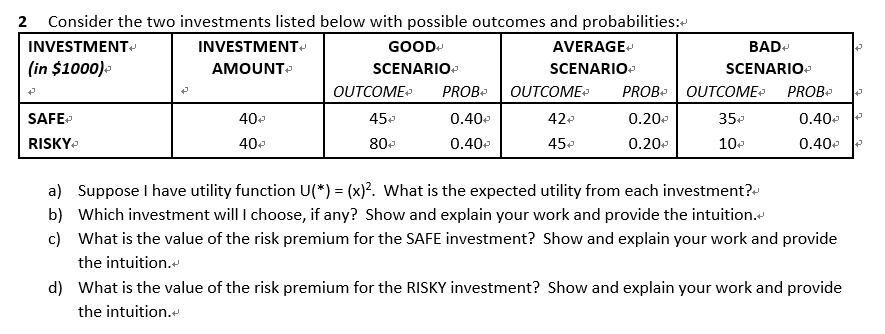

Answered 2 Consider The Two Investments Listed Bartleby

How To Deduct Private Mortgage Insurance Pmi For 2022 2023

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Insurance Deduction Legislation Introduced Themreport Com

How To Deduct Private Mortgage Insurance Pmi For 2022 2023

Ev Energy Credits New Tax Deductions

Jmd Tutorials Tybbi Revision Sheet Question Bank Prelim Papers With Solution Pdf Dividend Capital Asset Pricing Model

The Florida Horse June July 2022 Farm Service Directory By Florida Equine Publications Issuu

Some Important Tips Your Should Know Before Buying Term Plan

Answered 2 Consider The Two Investments Listed Bartleby

Is Mortgage Insurance Tax Deductible Bankrate

Is Mortgage Insurance Tax Deductible Bankrate

Is Mortgage Insurance Tax Deductible Bankrate

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

Is There A Mortgage Insurance Premium Tax Deduction

Trending News Archives Page 3 Of 9 St Croix Economic Development Corporation

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports